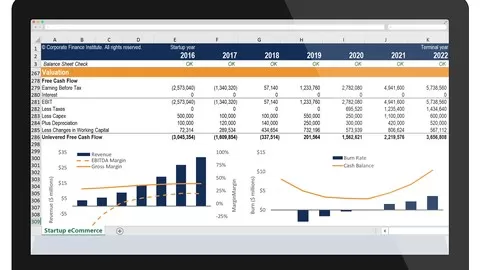

Course DescriptionLearn all the tips, tricks, shortcuts, functions and formulas you need to be an Excel power user. This course is designed specifically for Excel users who are performing professional financial analysis and financial modeling. We cover all levels – from beginner to advanced users.

Build a strong foundation in Excel for careers in:

•Investment banking•Private equity•Corporate development•Equity research•Financial Planning & Analysis (FP&A)Learn industry leading best practices. This course is based on first-hand investment banking training programs at global banks. The quality of instruction you receive in this course will have you just as sharp as if you took an expensive, live Wall Street course.

Content and Overview This course starts with the basics and quickly progresses to a level where even experts will learn something new. We think it’s important to start at the bottom and build a solid base, which is why we review all the foundational skills you need.

In the second half of the course you’ll notice the functions and formulas getting more sophisticated and the quality of financial analysis and financial modeling becoming much higher.

What am I going to get from this course?•Learn everything you need to know about Excel for a career in corporate finance•Master shortcuts, functions, and formulas to save time speed up you modeling skills•Follow industry leading best practices•Stand out in an interview or move up the ladder at work by dramatically boosting your Excel skills and confidence

Courses » Finance & Accounting » Financial Modeling & Analysis » Excel » Excel Crash Course: Master Excel for Financial Analysis

Disclosure: when you buy through links on our site, we may earn an affiliate commission.

Excel Crash Course: Master Excel for Financial Analysis

Beginner to Advanced: Learn Excel Shortcuts, Formulas & Functions for Financial Modeling & Corporate Finance

Created by

7.5

CourseMarks Score®

Freshness

Feedback

Content

Top Excel courses:

Detailed Analysis

CourseMarks Score®

CourseMarks Score® helps students to find the best classes. We aggregate 18 factors, including freshness, student feedback and content diversity.

Freshness Score

Course content can become outdated quite quickly. After analysing 71,530 courses, we found that the highest rated courses are updated every year. If a course has not been updated for more than 2 years, you should carefully evaluate the course before enrolling.

Student Feedback

New courses are hard to evaluate because there are no or just a few student ratings, but Student Feedback Score helps you find great courses even with fewer reviews.

Content Score

The top online course contains a detailed description of the course, what you will learn and also a detailed description about the instructor.

Tests, exercises, articles and other resources help students to better understand and deepen their understanding of the topic.

This course contains:

Table of contents

Description

You will learn

✓ At the end the course students will be able use industry best practices when building financial models in Excel

Requirements

This course is for

• The content is geared towards financial modeling and financial analysis used in investment banking, equity research, private equity and more.

How much does the Excel Crash Course: Master Excel for Financial Analysis course cost? Is it worth it?

Does the Excel Crash Course: Master Excel for Financial Analysis course have a money back guarantee or refund policy?

Are there any SCHOLARSHIPS for this course?

Who is the instructor? Is Tim Vipond a SCAM or a TRUSTED instructor?

Corporate Finance Institute® (CFI) is a leading financial analyst certification company that provides career-focused financial modeling training. CFI’s courses have been delivered to tens of thousands of individuals at the top universities, investment banks, accounting firms and operating companies in the world. CFI is the official provider of the Financial Modeling & Valuation Analyst (FMVA)™ designation.

Tim has over 12 years of experience in capital markets across a wide range of transactions including mergers, acquisitions, divestitures, and capital raising totaling more than $3 billion.

His professional experience includes investment banking, investment management, corporate development, strategy and corporate finance.

7.5

CourseMarks Score®

Freshness

Feedback

Content